Accuchex Offers the Best Agricultural Payroll Services in California

Accuchex is an industry expert in dealing with payrolls for agricultural entities. The Internal Revenue Service has separate and distinct rules for these employers which necessitate special handling. The state of California also has payroll and labor laws specific to agriculture employers.

Because of our location in northern California we work with many agricultural clients, including vineyards, vineyard and winery combinations, vineyard management companies, dairies and nurseries. This experience has provided Accuchex with the knowledge and understanding to expertly manage the reporting requirements and tax deposits for these various industry structures.

For example, the IRS Form 943 for agricultural employers is filed annually, while other non-farming operations (IRS Form 941) are reported quarterly. Accuchex offers both 943 (yearly) reporting AND 941 reporting (quarterly) in a consolidated manner, while our competitors can only do one or the other.

Another aspect of tax filing is that it’s often done under both methods for the same entity and a single FEIN. This approach requires that year-end reporting bring all this together to match the totals on all Forms W-2.

This is done while also tracking the wage limits of any employees working in both the agricultural and non-farming area of a company. In addition, all other requirements for reporting and tax deposits to state and other relevant agencies must be met.

At Accuchex, our payroll processing software can efficiently handle these calculations, while our Payroll Specialists monitor potential issues with new client set-up and payroll data entry. It’s this level of attention and our ability to take immediate corrective action that makes Accuchex your best choice for managing your agricultural payrolls.

Agriculture Overtime Pay Requirements

Another consideration for California agricultural employers is the Phase-In Overtime for Agricultural Workers Act of 2016.

California Wage Order No. 14 currently requires overtime for agriculture employees only after 10 hours worked in one day, or 60 hours per week. However, beginning in 2019, the Phase-In Overtime for Agricultural Workers Act of 2016 will bring in gradual changes in the overtime requirements to be completed over a four-year period.

There are two major aspects of the law that directly impact employers:

- The phasing in of the same overtime requirements for agriculture employees that already apply to all other California employees.

- The elimination of the existing Labor Code agricultural exemption for providing one day’s rest for every seven worked. Since January 1, 2017, agricultural employers have been prohibited from requiring employees to work more than six days consecutively without a rest day.

Because California is the largest agricultural employer in the U.S. and the largest provider of agricultural food products, the implementation of the new overtime pay requirements will likely lead to increased labor costs and, possibly, a resulting increase in the cost of produce.

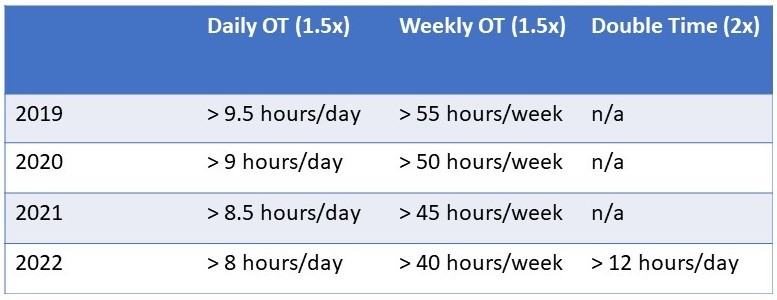

Overtime and Double Time Phase-in Schedule

Section 860 of the California Labor Code provides a phase-in schedule for the overtime requirements that agriculture employers will be subject to from 2019 through 2022. These changes will provide agricultural employees the same overtime benefits as all other California hourly employees.

Seventh Consecutive Day in a Workweek Overtime and Double Time

Beginning January 1, 2019, agricultural employees will be provided overtime pay for the first eight hours worked on the seventh consecutive day in a work week. For any hours worked beyond eight hours on a seventh consecutive day will paid as double time.

The overtime pay requirements apply to all California employers. Those employers with 26 or more workers will be required to comply with the four-year phase-in schedule from 2019 through 2022.

Employers with 25 or fewer workers have been provided with a seven-year schedule to comply with the phasing in of the overtime pay requirements.

When you are looking for California agricultural payroll services, Accuchex is your best choice. We provide services throughout the California Bay Area including the North Bay, South Bay, East Bay and San Francisco.